One of the big stories this month has been the collapse of several regional US banks, initiating a run for the exits from stablecoin USDC which temporarily traded below 0.9$ on the dollar.

It turned out that USDC had a significant portion of their cash reserves stored with Silicon Valley Bank, provoking uncertainty that the Circle/Coinbase consortium will be able to continue to redeem USDC at par value.

Due to more recent market memory, less sophisticated market participants were quick to draw parallels to the UST (Terra/Luna) implosion which went to zero in very short order after the initial de-peg.

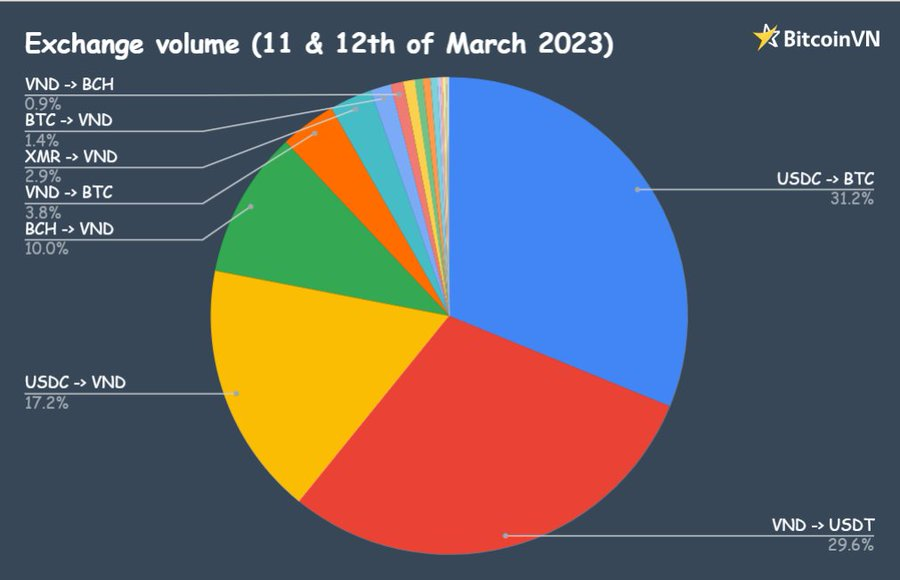

Some interesting numbers were provided by BitcoinVN, Vietnam’s premier Bitcoin Exchange, from their volume stats of this memorable weekend.

These saw combined USDC pair volume surge to close to half of the total exchange volume; and almost two thirds of the USDC unloaded went straight into Bitcoin rather than local currency Vietnamese Dong or alternative stablecoins.

Speak about a flight to safety!

On a side note, it seems interesting to note that XMR (Monero) transfers to VND showed more than double the volume than that of BTC, indicating that Monero potentially found a niche use case among retail remittances to Vietnam.

The strongest native cryptocurrency used to obtain Vietnamese Dong remains BCH (Bitcoin Cash), which accounted for about 10% of the overall exchange volume.

Circle CEO Jeremy Allaire took to the press (Twitter that is in the year of 2023) shortly thereafter and succeeded in restoring confidence. He clarified that the actual exposure to the current lot of bankrupt financial institutions has been limited and that Circle is ready to “cover any shortfall using corporate resources, involving external capital if necessary.”

Over the weekend Janet Yellen and the Fed ended up providing another veiled bailout for failing and overleveraged fractional reserve banks – making the insane (but expected) promise to provide a loan facility for junk assets at purchase price to any “system relevant” bank in trouble.

With any investment risk taken off the banks – expect the next round of the inflation cycle to be even more lunatic, resulting in ever greater capital misallocation.

The Fed will be ready and stand-by with the printer idling – to bail out failing banks by taking overpriced NFT’s and other speculative crap off their books at purchase price.

Talk about a free money spigot.