Bech32 native segwit addresses were first publicly proposed almost exactly two years ago, becoming the BIP173 standard. This was followed by the segwit soft fork’s lock-in on 24 August 2017.

“Scaling Bitcoin” had been a hot-debated issue over the last couple of years, a debate which got increasingly urgent and heated from 2015 on onwards when it was clear that a “conventional” raise of the maximum blocksize limit in Bitcoin is out of the question for a large part of the Bitcoin community in order to protect it’s decentralized properties which gives it it’s value and resilience in the first place.

Nonetheless at the height of the last “Crypto” bubble in 2017 which also saw Bitcoin shooting up to an exchange rate of 20,000 USD per Bitcoin transaction backlog on the Bitcoin main chain became extremely painful – with transaction fees going up to 50 or even over 100 USD in extreme cases and/or otherwise days of delay until a transaction was confirmed.

While we at BitcoinVN are big Bitcoin supporters, we can’t close our eyes about the challenges this situation posed to many service providers in the space. And while the bear market of 2018 and its following consolidation phase in 2019 provided much needed relief it is important that the industry and service providers keep improving their systems in order to make use of the technological opportunities the protocol provides in order to make Bitcoin “ready” to meet a sudden demand-spike like we saw it in 2017 with an improved infrastructure which reduces the pressure put on the main chain.

And while solutions like Sidechains, Lightning Network etc. are in the works and start being deployed by some first actors in the larger ecosystem; one of the “simple” scaling solutions is the utilization of Bech32/SegWit implementation in order to reduce the amount of data each transaction takes up in the Blockchain and therefore allow for a higher throughput at a reduced transaction fee cost.

While Bech32/SegWit in itself won’t be enough to make the main chain “ready” for another 2017-like spike in transaction demand – broad adoption across the ecosystem will definitely help to reduce the pressure on the limited space available in the Bitcoin main chain.

As the colleagues at whensegwit expressed it very much to the point:

“SegWit is an impressive upgrade that reduces effective transaction size and packs more transactions into the bitcoin network, which lowers fees and sets the foundation for future scaling prospects. Pretty much everybody who loves bitcoin agrees that the greater the SegWit adoption rate, the better off we’ll be.

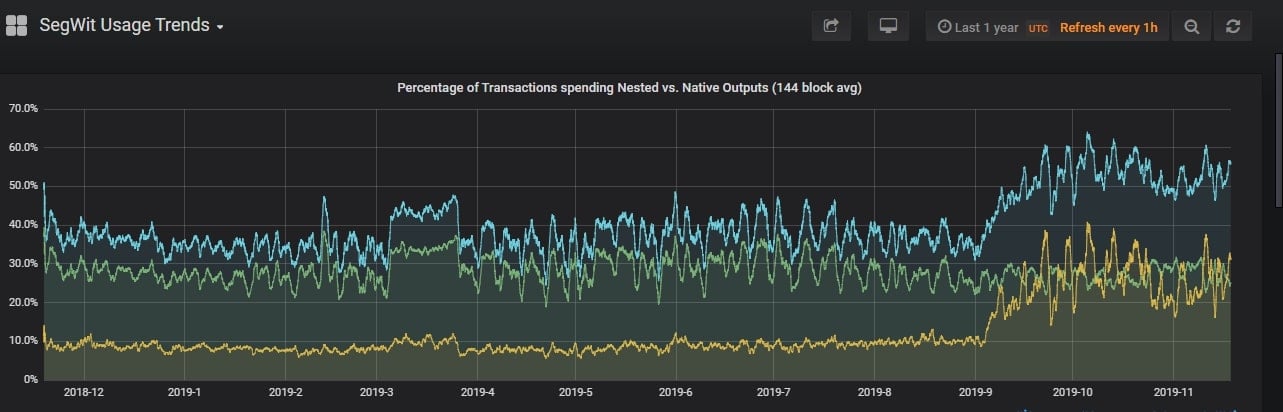

Yet, surprisingly, SegWit is only utilized by around 40% of bitcoin transactions today. This means the throughput of the bitcoin network is not fully optimized. Available space is being wasted, which results in higher fees for everyone. Right now fees are fairly affordable, but we could easily see transaction fees in the tens or hundreds of dollars again, just like we did in 2017. So why hasn’t SegWit reached 100% adoption?

One reason could be a lack of sufficient incentives. The majority of current SegWit transactions are wrapped inside of an address format called P2SH, which is backwards-compatible with clients that don’t support SegWit. This allows the receiver of a transaction to utilize SegWit even if the sender doesn’t support it yet. This is a great way to let individual users do their own part to drive adoption forward, but it doesn’t do much to encourage the sender of the transaction to upgrade. P2SH-segwit is substantially better than legacy addresses, but it isn’t the best option available.

Bech32 is a new address format created specifically for SegWit. It allows the direct use of SegWit without the wrapper, on top of other improvements such as more efficient QR codes, and better error correction, but is not readable by clients that don’t support it. The hope for SegWit, as shared many industry experts, is to transition fully to Bech32 and move away from wrapping SegWit transactions in P2SH.”

BitcoinVN is happy to announce that you can withdraw/send any purchases made from Bitcoinvn.io to a valid Bech32/SegWit address which will not only help you to save on transaction fees for moving your Bitcoins – but also helps the wider Bitcoin ecosystem to increasingly adopt this new transaction standard in order to get more and more Bitcoin transactions utilizing this more efficient standard.

A first step of many more to come to make Bitcoin “scale-able” in a sustainable manner – and BitcoinVN is proud to play its part in it.