The great unwinding of “money creation out of thin air” has provided us with another month of entertainment, as fiat investors saw initially their banks in North America blowing up (starting with some of the “crypto-friendly” banks such as Silvergate and quickly spreading to Silicon Valley Bank and Signature bank), followed within days by distress signalized at their European counterparts at Credit Suisse, BNP Paribas and others.

Caitlin Long of Custodia Bank has been warning against the inevitable for years – and maybe never more succinctly than in her 2021 appearance at Bitcoin Magazine’s annual Bitcoin conference.

“Even those of us who are not leveraged have the downside that the price is more volatile – it increases the cost of capital for everybody in the industry”

One of the major reasons behind that the remittance market has been mostly taken over by Tether and other stablecoins is the ongoing volatility of Bitcoin.

Volatility forces wider spreads on market participants to hedge out their risks – at which point the utilization of a stablecoin like Tether simply becomes more economical.

Especially in the high volume remittance market a difference of tens of basis points is a massive difference which makes Bitcoin entirely uncompetitive for this market segment.

Commodity credit and circulation credit

Circulation credit is a more technical term for IOU’s which are not backed by any underlying real savings – or in more plain terms: Fraud.

When unbacked IOU’s (“paper Bitcoin”) are generated en masse by centralized custodians or fractional reserve lenders and treated (temporarily) as equivalent to the actual underlying money, it allows the generators of these paper Bitcoins to exchange real goods and services for unbacked paper Bitcoin.

A “get rich fast” scheme that works for the originators of these paper Bitcoin – at the cost of everyone else who is restricted to holding the actual underlying Bitcoin.

However – since those paper Bitcoin are not backed by real Bitcoin the overleveraged scheme is due to collapse from time to time – and opposite to the fiat monetary system, there is no Central Bank which simply can “print the difference” to bail out fractional reserve operators.

The bagholders become those who are left holding the unbacked IOU’s rather than the real Bitcoin once the music stops.

Don’t let this happen to you – and withdraw your Bitcoin to your own wallet.

Claims to the underlying out of thin air

If you have 100 people believing they own a Bitcoin (because they hold a paper Bitcoin balance), while actually only one real Bitcoin is available… trouble is mathematically certain.

With fractional fiat money banks (in the business of generating fiat IOU’s), they can from time to time make up the difference by calling up their buddies at the central bank to print up some more underlying fiat – be it dollars, yen, pounds, euros… – there is an infinite amount of cash at the Federal Reserve.

The good news is:

Your bank will in such a system never be at risk to not honour your IOUs.

The lender of last resort is ready to jump into action with its printing press whenever too many people at once try to convert their unbacked circulation credit into the underlying fiat money.

Yay!

Yay?

The bad news:

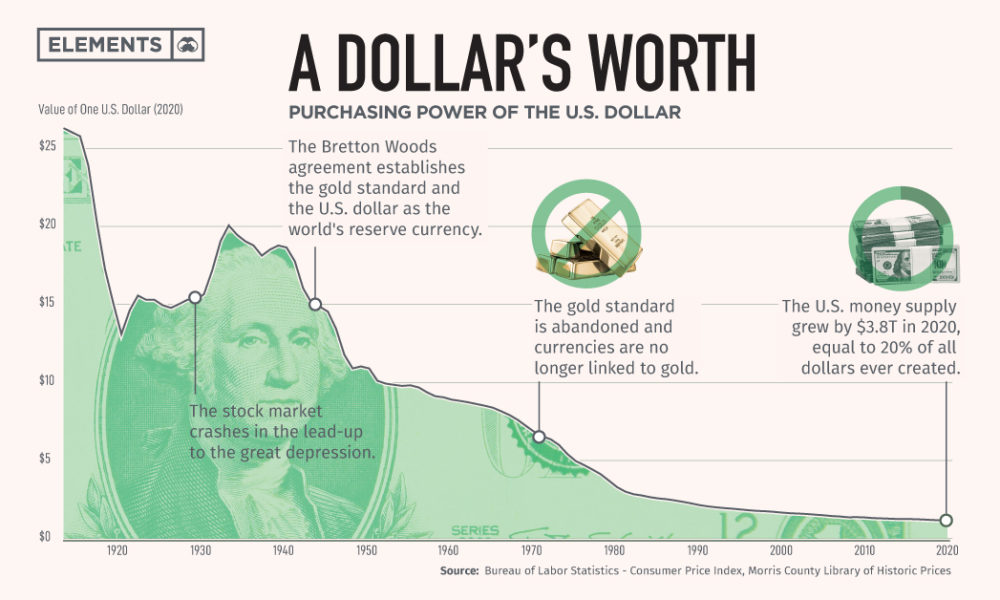

This regular occurrence of needing to print the difference between underlying fiat and the massively inflated issued circulation credit due to the nature of fractional reserve banking… means there will ever be more underlying fiat in existence.

And that means… the value of each of these units will continuously getting debased.

Holding fiat is a mathematically certain bet to lose your purchasing power as time goes on.

The solution?

Well, Satoshi’s got a plan for you.